Therapy isn’t just about the copay - here’s what else you’re really paying

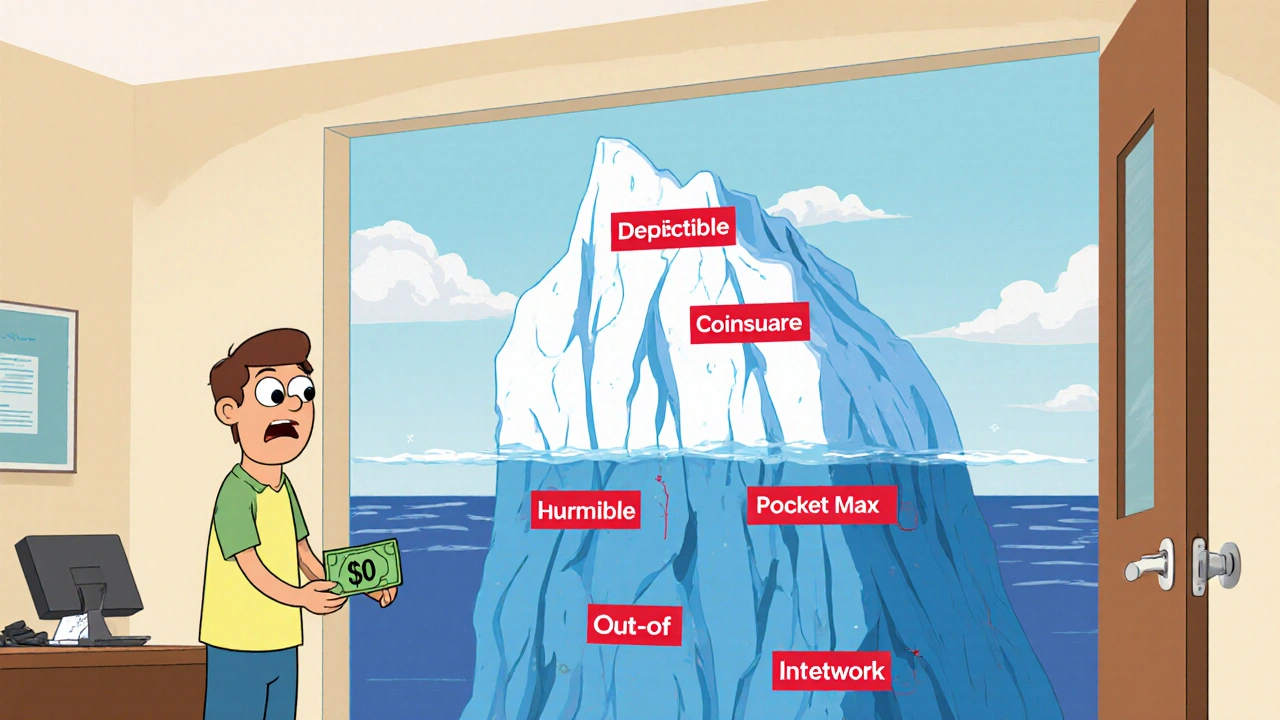

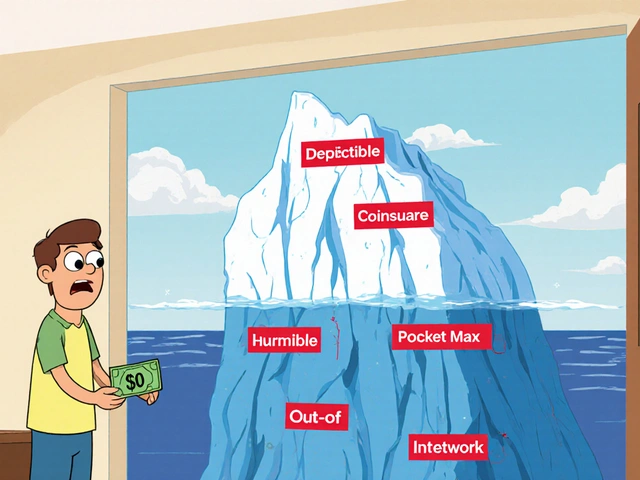

You show up for your therapy session, swipe your card, and pay $30. Easy. But that $30? It’s just the tip of the iceberg. If you think that’s all you’re spending on therapy this year, you’re in for a surprise. Many people don’t realize their insurance plan might be hiding big costs behind the scenes - until they get a bill for $1,200 after just six sessions.

The truth is, therapy cost goes far beyond what you pay at the door. It includes your deductible, coinsurance, out-of-pocket maximum, session frequency, whether your therapist is in-network, and even how your plan treats mental health versus physical health. And if you’re on Medicare, Medicaid, or have no insurance at all? The math changes again.

Understand your insurance plan type - it changes everything

Not all insurance plans work the same way. There are three main structures, and each affects your total cost differently.

- Copay plans: You pay a fixed amount per session - say $30 or $50 - and your insurance covers the rest. Sounds simple, right? But only if you’ve already met your deductible. If you haven’t, you might be paying the full session rate until you hit that number.

- Deductible plans: You pay 100% of the session cost until you’ve spent a certain amount - your deductible - in a year. For example, if your deductible is $1,500 and each session costs $125, you’ll pay full price for 12 sessions before insurance kicks in.

- Coinsurance plans: After you meet your deductible, you pay a percentage - often 20% to 40% - of what your insurance allows for each session. So if the allowed amount is $125 and your coinsurance is 30%, you pay $37.50 per session. But here’s the catch: if your therapist charges more than the allowed amount, you pay the difference.

Thriveworks’ 2024 study of over 175,000 therapy sessions found that patients on coinsurance plans often pay more overall than those on flat copays - especially if they need more than 15 sessions. Why? Because coinsurance adds up fast. A 30% coinsurance on $125 sessions over 20 sessions after a $2,000 deductible? That’s $2,000 + $750 = $2,750 total. Not $30 per session.

In-network vs. out-of-network: The hidden cost multiplier

Choosing a therapist who’s “in-network” with your insurance can cut your bill by half - or more. In-network providers agree to a set rate with your insurer. Out-of-network providers don’t. That means you pay the full fee upfront, then submit a claim hoping for partial reimbursement.

According to Alma’s 2023 cost analysis, patients using out-of-network therapists typically pay 40-50% of the session cost after meeting their deductible. In-network? Often 20-30%. So if your session is $150 and you’re paying 45% coinsurance out-of-network, you’re paying $67.50 per session. In-network? Maybe $30. That’s a $37.50 difference per session. Over 20 sessions? That’s $750 extra.

And don’t forget location matters. Therapy costs range from $176 per session in New York to $227 in North Dakota. Your coinsurance percentage might be the same, but the dollar amount isn’t. A 20% coinsurance on $227 is $45.40. On $176? Just $35.20. That’s $100+ extra per month in some areas.

How many sessions will you actually need?

Most people assume therapy lasts 6-8 weeks. But real recovery often takes longer. Grow Therapy’s 2023 data shows:

- 12-16 sessions for moderate anxiety or depression

- 15-20 sessions for PTSD, complex trauma, or long-standing issues

- 30+ sessions for chronic conditions or when combined with medication management

Shasta Health found nearly 40% of patients didn’t know their copay until after they started therapy - and many were shocked by the total. If you’re paying $40 per session and going weekly for 20 weeks? That’s $800. If you’re on coinsurance and need 25 sessions after a $3,000 deductible? You could be looking at $4,500 total.

Plan ahead. Don’t wait until you’re halfway through therapy to realize you’ve spent more than your rent.

Your out-of-pocket maximum isn’t a suggestion - it’s your safety net

Every insurance plan has an annual out-of-pocket maximum. In 2024, that’s $9,350 for individuals and $18,700 for families. Once you hit that number, your insurance pays 100% of covered services for the rest of the year.

But here’s what most people miss: this limit includes your deductible, copays, and coinsurance - but only for in-network care. Out-of-network costs often don’t count toward it. And some plans have separate deductibles for mental health and medical care. So if your medical deductible is $1,500 and your mental health deductible is $1,000, you’re paying two separate bills before coverage kicks in.

If you’re on a high-deductible plan and need ongoing therapy, your out-of-pocket maximum might be your only real protection. But only if you track every dollar you spend - and know what counts.

Medicare, Medicaid, and sliding scales: What if you’re uninsured?

If you’re on Medicare, you pay 20% of the allowed amount after meeting your Part B deductible. Thriveworks reports the average Medicare patient pays $28.65 per session. But that’s only if your therapist accepts Medicare assignment. If they don’t? You could pay the full fee.

Medicaid usually has little to no copay. But not all therapists take it. Check ahead.

For those without insurance, help exists:

- 42% of private practice therapists offer sliding scale fees based on income - often 30-50% off.

- Open Path Collective connects people with therapists who charge $40-$70 per session.

- University training clinics offer sessions for 50-70% less, supervised by licensed professionals.

These aren’t last resorts - they’re smart financial choices. And they require a different calculation: your income, not your insurance card.

Build your real therapy budget - step by step

Here’s how to calculate your total therapy cost for the year - no guesswork:

- Find your plan type - copay, deductible, or coinsurance? Call your insurer or check your online portal.

- Confirm your deductible - Is it $1,000? $3,000? And is mental health separate?

- Ask for the allowed amount - What’s the max your insurer pays per session? If your therapist charges $150 but the allowed amount is $120, you pay the extra $30.

- Estimate your sessions - Will you need 12? 20? 30? Use Grow Therapy’s benchmarks as a starting point.

- Calculate Phase 1 (pre-deductible) - How many sessions until you hit your deductible? Multiply that by the full session cost.

- Calculate Phase 2 (post-deductible) - Multiply remaining sessions by your copay or coinsurance rate.

- Add your premiums - Multiply your monthly insurance payment by 12.

- Check the out-of-pocket maximum - Is your total projected cost close to it? If so, you’re safe after hitting the cap.

- Include extras - Transportation, time off work, medication co-pays. These add up too.

Example: You have a $2,000 deductible, 20% coinsurance, and a $125 session rate. You need 20 sessions.

- Phase 1: $2,000 ÷ $125 = 16 sessions at full price = $2,000

- Phase 2: 4 sessions × 20% of $125 = $100

- Total out-of-pocket: $2,100

Without insurance? 20 sessions × $125 = $2,500. Insurance saved you $400. But only if you knew to do the math.

Tools to help you track it all

You don’t have to do this alone.

- Use your insurer’s online portal - many let you estimate costs based on your provider and session count.

- Try Alma’s free Cost Estimator Tool - it shows your remaining deductible and projected copay.

- Check Rula’s cost estimator - users report averages as low as $15 per session, depending on plan.

- GoodRx has a mental health cost tracker - useful for comparing cash prices if you’re uninsured.

Don’t wait for a surprise bill. Set up a simple spreadsheet. Track each session. Note whether it counts toward your deductible. Update it monthly. It takes 10 minutes - and could save you thousands.

Final tip: Time your therapy with your insurance year

Your deductible resets every January. If you can start therapy early in the year, you’ll hit your out-of-pocket maximum faster - and get full coverage sooner. If you wait until November? You might pay full price for months with no relief.

Also, if you have other medical bills - like physical therapy, lab tests, or prescriptions - schedule them early. Most plans count all covered services toward the same deductible. So a $200 MRI in March could help you meet your mental health deductible faster.

Therapy is worth it. But it shouldn’t break you. The key isn’t just finding the right therapist - it’s understanding the system that pays for them. Do the math. Ask the questions. Track the numbers. You’ve already taken the hardest step: showing up. Now make sure your wallet shows up too.

Is my copay the only thing I pay for therapy?

No. Your copay is just one part. You may also pay your deductible, coinsurance, and out-of-pocket costs before your insurance fully kicks in. If you haven’t met your deductible, you could be paying the full session rate - not just your copay. Always check your plan details.

What’s the difference between in-network and out-of-network therapists?

In-network therapists have agreed rates with your insurance. You pay a set copay or coinsurance. Out-of-network therapists don’t, so you pay the full fee upfront and then submit a claim for partial reimbursement. You often pay more - sometimes 40-50% of the cost - and it may not count toward your out-of-pocket maximum.

How do I know how many therapy sessions I’ll need?

Most people see improvement after 12-16 sessions. For complex issues like PTSD or long-term depression, 15-20 sessions are common. Some need 30 or more. Talk to your therapist about your goals. Don’t assume therapy ends after six weeks - plan for the long haul.

Can I use my health savings account (HSA) for therapy?

Yes. Therapy is a qualified medical expense under HSA and FSA rules. You can use pre-tax dollars from these accounts to pay for copays, coinsurance, or even full session fees if you’re uninsured. Keep receipts - you’ll need them for tax purposes.

What if I can’t afford therapy even with insurance?

Many therapists offer sliding scale fees based on income - often 30-50% off. Open Path Collective connects people with therapists charging $40-$70 per session. University training clinics offer services at 50-70% below market rates through supervised students. Don’t give up - affordable options exist.

Does Medicare cover therapy?

Yes. Medicare Part B covers 80% of the approved amount for therapy after you meet your annual deductible. You pay 20% - which averages about $28.65 per session. If your therapist doesn’t accept Medicare assignment, you may pay more. Medigap Plan G can cover that 20% coinsurance.

Why does my therapy cost vary so much by state?

Therapy costs vary by region due to cost of living, therapist supply, and local market rates. In New York, sessions average $176. In North Dakota, they’re $227. Your coinsurance percentage stays the same, but the dollar amount doesn’t. Always check local rates before choosing a provider.

Do all medical expenses count toward my mental health deductible?

Not always. Some plans have separate deductibles for medical and mental health care. Others combine them. Call your insurer and ask: “Do all covered services count toward my mental health deductible?” Don’t assume - confirm.

man i had no idea therapy could cost this much 😅 i thought my $30 copay was it, but then i got a bill for $900 after 10 sessions and nearly had a heart attack. turns out i was still in deductible mode and my therapist was just barely in-network. never check your insurance until you’re already in therapy, lol. now i keep a spreadsheet like the article says - 10 minutes a month, saved me like $1200 this year.

i just started therapy last month and honestly i was terrified of the cost but this post made me feel less alone. i’m on coinsurance and my deductible is $2500 so i’ve been paying full price for 8 sessions already. i cried when i realized i’d spent more on therapy than my phone bill. but i’m glad i’m doing it. mental health isn’t optional. just wish it didn’t feel like a financial gamble.

As someone from India where therapy is still stigmatized and often unaffordable even without insurance, I find this article deeply insightful. In many parts of the world, the concept of sliding scales or in-network providers does not exist. The structural barriers to mental healthcare in the U.S. are complex, but at least there is awareness and tools being developed. I commend the effort to demystify costs - this is the kind of transparency that can empower people globally to advocate for better systems.

HOW IS THIS EVEN LEGAL?!! You’re telling me my insurance company can charge me $2,750 for 20 sessions and call it ‘coverage’? And they don’t even count out-of-network costs toward my out-of-pocket max?? That’s not insurance, that’s a predatory loan with a therapist attached. I’ve been paying $60 per session for 18 months and I’ve hit my max twice and still got billed for ‘excess provider charges’ because my therapist ‘chose’ to charge $150 when the allowed amount was $120. This system is broken. Someone needs to sue these companies. I’m not joking. I’m done being polite about this.

big respect to whoever wrote this - i was about to quit therapy because i thought i couldn’t afford it, but after reading this i sat down and actually did the math like they said. turns out i’m only $300 away from hitting my out-of-pocket max, and after that, it’s basically free for the rest of the year. so i’m sticking with it. also found a sliding scale therapist through Open Path and now i’m paying $50 instead of $110. life changing. you don’t have to suffer in silence or bankruptcy. just do the homework. it’s annoying but worth it.

my therapist is in network but i didn’t realize my deductible was separate for mental health. i thought my $1500 medical deductible covered everything. then i got hit with another $1000 just for therapy. i’m not mad, just stupid. now i call my insurance every time i start a new thing - physical therapy, therapy, acupuncture. all different deductibles. it’s wild. also hsa is a lifesaver. i use mine for everything now. no receipts? no problem, i screenshot the portal.

the fact that this post exists and isn’t just a reddit meme says something. i used to think therapy was a luxury. now i know it’s a financial obstacle course with a couch at the end. my favorite part? when they say ‘Medicare pays 80%’ - cool, but what if your therapist charges $200 and the allowed amount is $130? congrats, you just paid $100 out of pocket for a $26 copay. this isn’t healthcare, it’s a game of thrones with a billing department.

you know what’s wild? we spend hours comparing phone plans but never compare therapy costs like we’re buying a car. why? because we’re taught to feel guilty for caring about money when it comes to healing. but healing is expensive. and if you’re poor, you’re supposed to just ‘be grateful’ for whatever scraps the system gives you. i’m tired of that. i’m tired of being told to ‘just find a sliding scale’ like it’s a magic trick. this article? it’s a survival guide. i printed it. i have it taped to my fridge next to my grocery list. mental health is a right. not a privilege. and we need to fight for that - with spreadsheets and phone calls and receipts.

as an Irishman who got therapy in the States last year, i was shocked. here, you pay €30-50 per session and that’s it - no deductibles, no coinsurance, no ‘allowed amounts’. the state subsidizes it. i didn’t realize how lucky i was until i got hit with a $1,200 bill in Chicago. i still think about it. this article should be mandatory reading for anyone moving to the US. seriously. i wish i’d had this before i started.

you’re not alone 💛 i started therapy in January and by April I’d already hit my out-of-pocket max - thanks to a bunch of lab tests and physical therapy sessions I didn’t even think counted. now I’m getting therapy for free for the rest of the year and it feels like a gift. i’m so glad i didn’t quit. you’ve already done the hardest part - showing up. now go check your portal. it might be easier than you think. you got this 🌻

if you’re paying more than $150 per session in NYC, you’re doing it wrong. everyone knows the real cost is your time, your trauma, and your willingness to be vulnerable - not your coinsurance percentage. this article reads like a corporate insurance pamphlet. therapy isn’t a spreadsheet. it’s a revolution. stop calculating your healing like you’re budgeting for a vacation.

just moved from Australia where therapy’s subsidized through Medicare. here in the US? i thought my insurance was gonna help. instead i got a bill for $780 after 6 sessions. now i’m using a uni clinic for $40 a pop. it’s supervised students but honestly? they’re better than some licensed therapists i’ve had. the system is messed up but you can still get help. just don’t trust the insurance rep. they’re paid to say yes.

my therapist is out of network but she lets me pay $60 a session and i submit for reimbursement. it takes 6 weeks and i usually get back $35. so i’m really paying $25. it’s annoying but worth it. i also use my hsa card like a debit card - no receipts needed if you’re not audited 😅 this article helped me realize i’m not being cheap - i’m being smart.

you people are so reductionist. you reduce healing to dollars and cents, to deductibles and coinsurance percentages - as if the soul can be calculated like a mortgage. therapy isn’t a transaction. it’s a sacred unraveling. you think tracking your sessions in a spreadsheet will heal your childhood trauma? no. it will just make you feel more like a consumer. the real cost of therapy isn’t what you pay - it’s what you refuse to feel. and you’re all so busy counting your coins you’ve forgotten to cry.

the article correctly identifies the structural inefficiencies in behavioral health reimbursement, but fails to address the provider-side constraints: fee-for-service models incentivize higher session volumes over clinical outcomes, and payer-provider contracts often lack transparency in allowable amounts. from a health economics standpoint, the fragmentation of mental health benefits under separate deductibles constitutes a classic case of moral hazard and adverse selection. solution? integrate mental health into primary care reimbursement pathways and implement value-based payment models with bundled episode-of-care payments.