Copay: Understand Your Medication Costs and How to Reduce Them

When you pick up a prescription, the copay, a fixed amount you pay out-of-pocket for a covered drug at the pharmacy. Also known as a co-payment, it’s the part of your drug cost your insurance doesn’t cover upfront. It sounds simple—$10 for a generic, $40 for a brand-name—but for many, that $40 is the difference between taking your meds or skipping them. And it’s not just about the price tag. Copays are tied to bigger issues like insurance design, drug pricing, and whether your plan even covers what you need.

Behind every copay is a system that often doesn’t make sense. Your insurance might charge a high copay for a drug that’s been on the market for 20 years, while a newer, more expensive drug gets a lower copay because the manufacturer pays the insurer a rebate. That’s why you might pay more for generic lisinopril, a common blood pressure medication than for a newer brand-name version. Or why your plan might deny coverage for Imitrex, a migraine treatment unless you try cheaper alternatives first. This isn’t about safety—it’s about who pays what, and how insurers push you toward drugs that give them the best deal, not necessarily the best outcome for you.

And then there’s the hidden cost: skipping doses because of copays. Studies show nearly half of people with chronic conditions skip or cut pills because they can’t afford them. That’s not laziness. That’s a system that makes health expensive. If you’re on duloxetine, an antidepressant often used for nerve pain, and your copay jumps from $15 to $60, what do you do? You might call your doctor to ask about alternatives, check if an authorized generic exists, or even appeal your insurance denial. These aren’t just medical decisions—they’re financial ones. And you’re not alone. Many people are stuck between their health needs and their bank account.

Thankfully, there are ways to fight back. You can ask your pharmacist if a different formulation costs less. You can check if your drug has a manufacturer coupon. You can appeal a denied claim—something we’ve covered in detail for brand-name meds. You can even switch to a different insurance plan during open enrollment if your current one keeps hitting you with high copays. The key is knowing your options before you’re forced to choose between food and your pills.

In the posts below, you’ll find real, practical advice on how to handle copays and related costs. From how to appeal insurance denials for expensive drugs, to understanding why generics sometimes cost more than brands, to spotting hidden fees in your prescription plan. You’ll learn how comorbidities can multiply your medication costs, how to read labels to avoid accidental overdoses, and how to talk to your care team about side effects that might be making your meds harder to afford. These aren’t theoretical tips—they’re tools used by people who’ve been there.

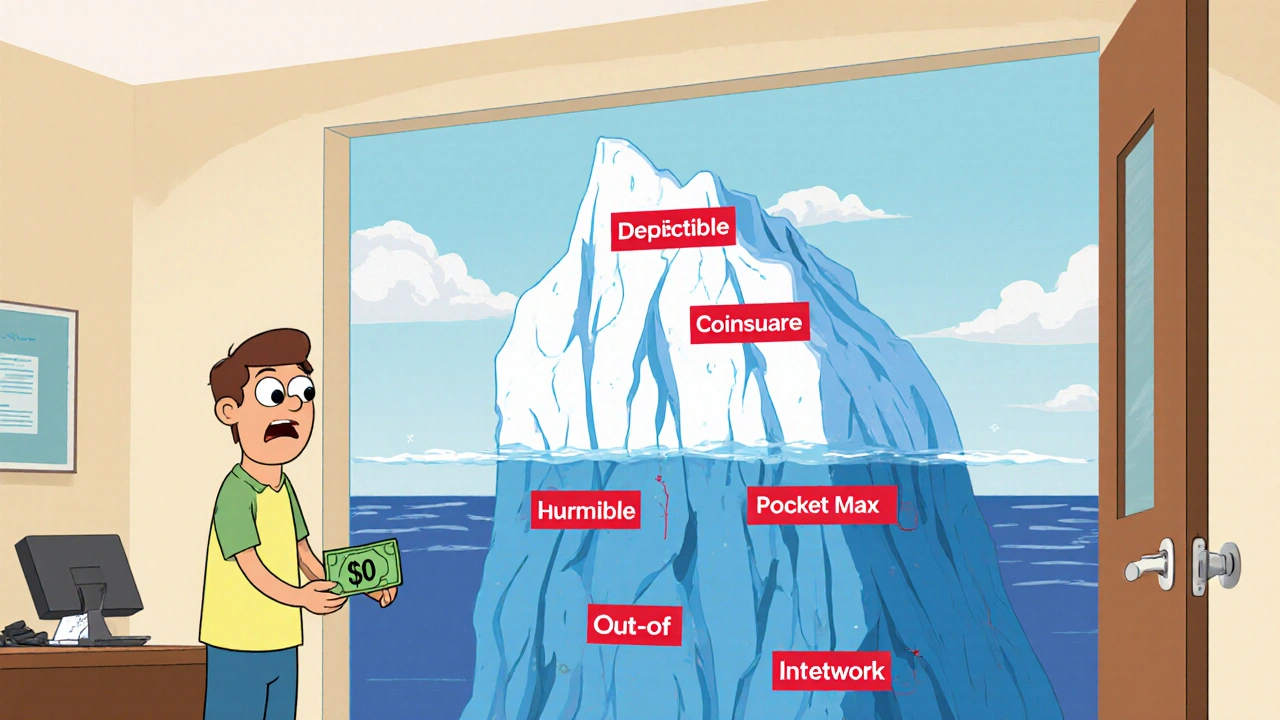

How to Calculate Total Cost of Therapy Beyond the Copay

Therapy costs go far beyond your copay. Learn how deductibles, coinsurance, in-network vs. out-of-network providers, and session frequency affect your total out-of-pocket expenses for mental health care.