Insurance Therapy: How Coverage Impacts Your Medication Access and Treatment

When we talk about insurance therapy, the process of using health insurance to authorize, limit, or deny access to prescribed medications. Also known as coverage-driven treatment, it’s not a medical procedure—it’s a system that decides if, when, and how you get your drugs. This isn’t just paperwork. It’s the difference between managing your condition and watching it worsen because your insurer won’t cover the right pill.

Insurance denial appeal, the formal process to challenge a refused prescription claim is one of the most common real-world interactions with insurance therapy. People don’t skip meds because they’re careless—they skip them because the cost is impossible, or their insurer demands prior authorization for a drug their doctor says they need. Drug coverage, the specific list of medications an insurance plan will pay for varies wildly between plans, even within the same province. One plan might cover your brand-name heart med; another only pays for the generic—even if the generic made you sick last time.

Insurance therapy doesn’t stop at approval. It shapes how you take your meds. If your insurer requires step therapy—forcing you to try cheaper drugs first—you might endure weeks of uncontrolled pain or high blood pressure before getting the right treatment. That delay isn’t just inconvenient; studies show it increases hospital visits and long-term damage. And when you finally get approval, the paperwork doesn’t end. You might need to re-appeal every year, or your doctor has to submit new forms just to refill your prescription.

It’s not just about cost. Insurance therapy affects who gets treated at all. People with complex conditions—like autoimmune disorders, chronic pain, or mental health issues—are hit hardest. Their meds are often expensive, require special monitoring, or are labeled "non-preferred" by insurers. That’s why treatment adherence, how consistently a patient takes their medication as prescribed drops so sharply when insurance barriers pile up. Half of all patients skip doses not because they don’t care, but because the system made it too hard.

What you’ll find below isn’t a list of drug reviews. It’s a practical guide to surviving insurance therapy. You’ll read how to appeal a denial for brand-name meds, what to say when your insurer says "no," how to spot when a generic isn’t safe for you, and why some drugs are blocked even when they’re the best choice. You’ll learn how comorbidities make coverage harder, how family members can help manage the paperwork, and what to do when your only option is an expired pill because your insurance won’t cover the new one. These aren’t theoretical problems—they’re daily realities for people managing chronic conditions in Canada. This collection gives you the tools to push back, understand your rights, and get the care you’re supposed to have.

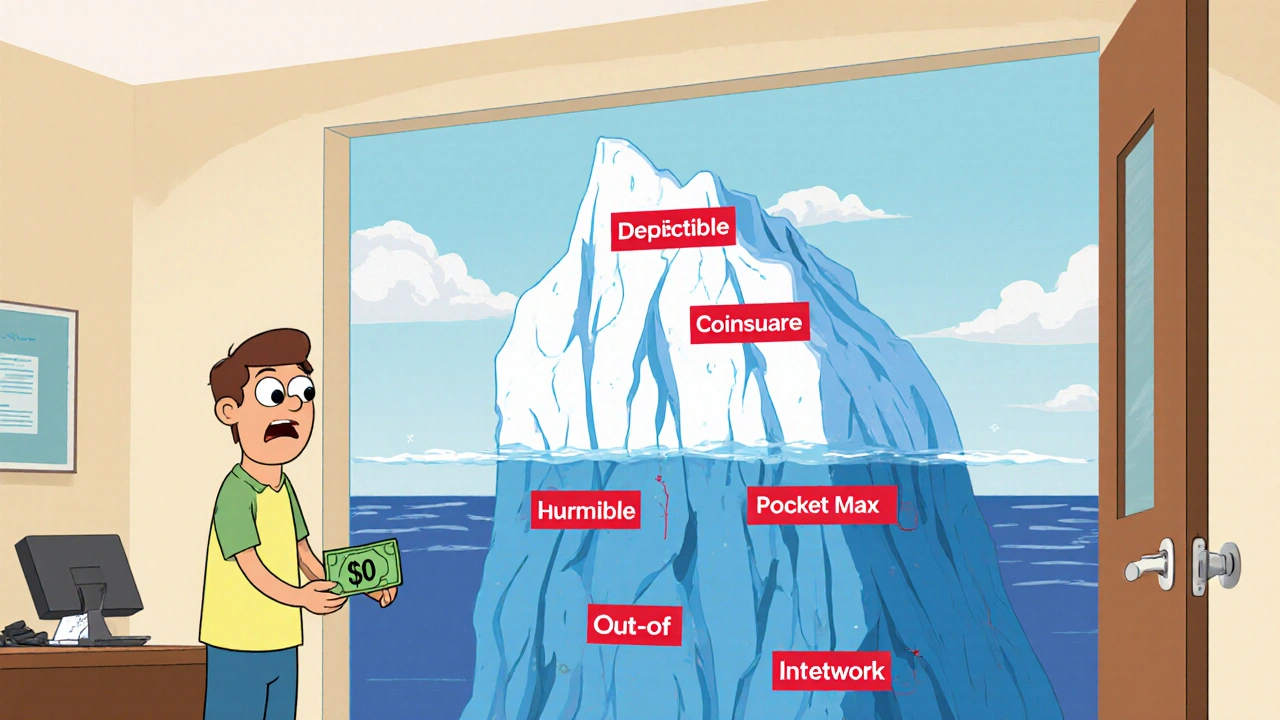

How to Calculate Total Cost of Therapy Beyond the Copay

Therapy costs go far beyond your copay. Learn how deductibles, coinsurance, in-network vs. out-of-network providers, and session frequency affect your total out-of-pocket expenses for mental health care.