Out-of-Pocket Therapy: What It Costs and How to Manage It

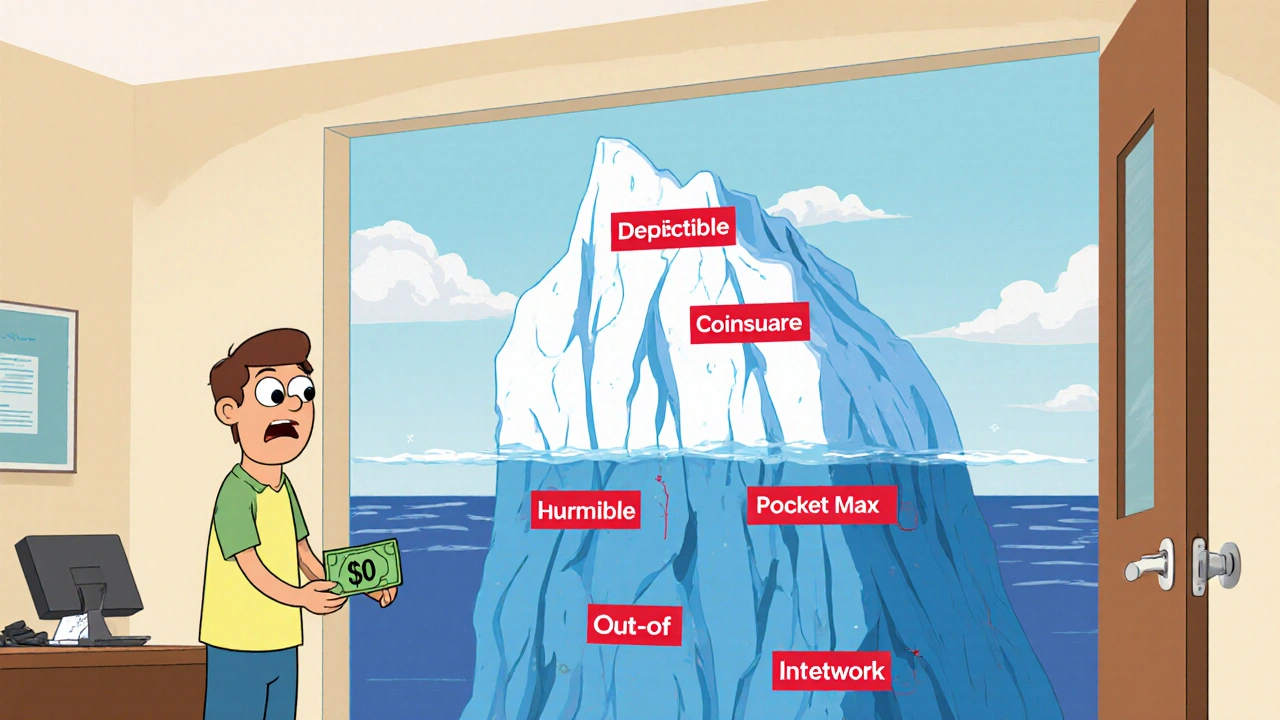

When you pay for your meds yourself—no insurance, no help—that’s out-of-pocket therapy, the direct cost of medications and treatments paid by the patient without insurance coverage. Also known as direct patient payment, it’s not just about the price tag on the bottle. It’s about choosing between food, rent, or your next pill. And for millions in Canada, that choice is real. You might think your drug is covered, but if your plan has a high deductible, excludes brand-name drugs, or won’t approve prior authorization, you’re stuck paying full price. That’s out-of-pocket therapy in action.

It’s not just about expensive brand-name pills. Even generics can add up fast if you’re taking three or four daily. A medication adherence, how consistently a patient takes their prescribed drugs problem isn’t always about forgetting—it’s about affordability. Half of all patients skip doses because they can’t afford them. And when you skip, your condition worsens, which often leads to hospital visits, ER trips, and even higher costs down the line. That’s the cycle: high out-of-pocket therapy leads to nonadherence, which leads to more expensive care.

Some people turn to generic drugs, lower-cost versions of brand-name medications approved by health regulators to cut costs. But not all generics are equal. Authorized generics—made by the same company as the brand—can be closer in effect. Then there’s the risk of buying cheap meds online, which might be fake, expired, or unsafe. And if your insurance denies your brand-name drug, you might need to appeal. That’s where knowing how to file a proper insurance denial appeal, the formal process to challenge a refused medication claim becomes critical. You need the right paperwork, your doctor’s support, and sometimes, a letter explaining why the generic won’t work for you.

Comorbidities make this harder. If you have diabetes and heart disease, you’re on five or six drugs. Each one adds to your monthly bill. And some meds interact with others—like omeprazole reducing clopidogrel’s effect, or green tea extract messing with blood pressure pills. That means more doctor visits, more tests, more costs. You’re not just paying for pills. You’re paying for the whole system around them.

There’s no magic fix. But there are real steps: asking for samples, checking patient assistance programs, comparing prices at different pharmacies, using mail-order services, and talking to your pharmacist about cheaper alternatives. Some people split pills (with doctor approval). Others switch to therapies covered under provincial programs. And some fight back—by appealing denials, documenting side effects, or proving a generic failed them.

What you’ll find below are real stories and practical guides from people who’ve been there. How to get your insurance to cover a brand-name drug. Why some meds are safer than others when you’re on a tight budget. What to do when you can’t afford your HRT, your blood pressure pill, or your antidepressant. No fluff. No theory. Just what works when your wallet’s empty and your health’s on the line.

How to Calculate Total Cost of Therapy Beyond the Copay

Therapy costs go far beyond your copay. Learn how deductibles, coinsurance, in-network vs. out-of-network providers, and session frequency affect your total out-of-pocket expenses for mental health care.