Ever wonder why your generic blood pressure pill costs $12 in Ohio but $45 in California-even though it’s the exact same drug? You’re not imagining it. Generic drugs, which make up 90% of all prescriptions filled in the U.S., don’t have a national price tag. Instead, what you pay depends almost entirely on where you live. This isn’t about brand names or fancy packaging. It’s about how your state handles drug pricing, who controls the middlemen, and whether your insurance even knows what the drug actually costs.

Why the Same Pill Costs So Much More in Some States

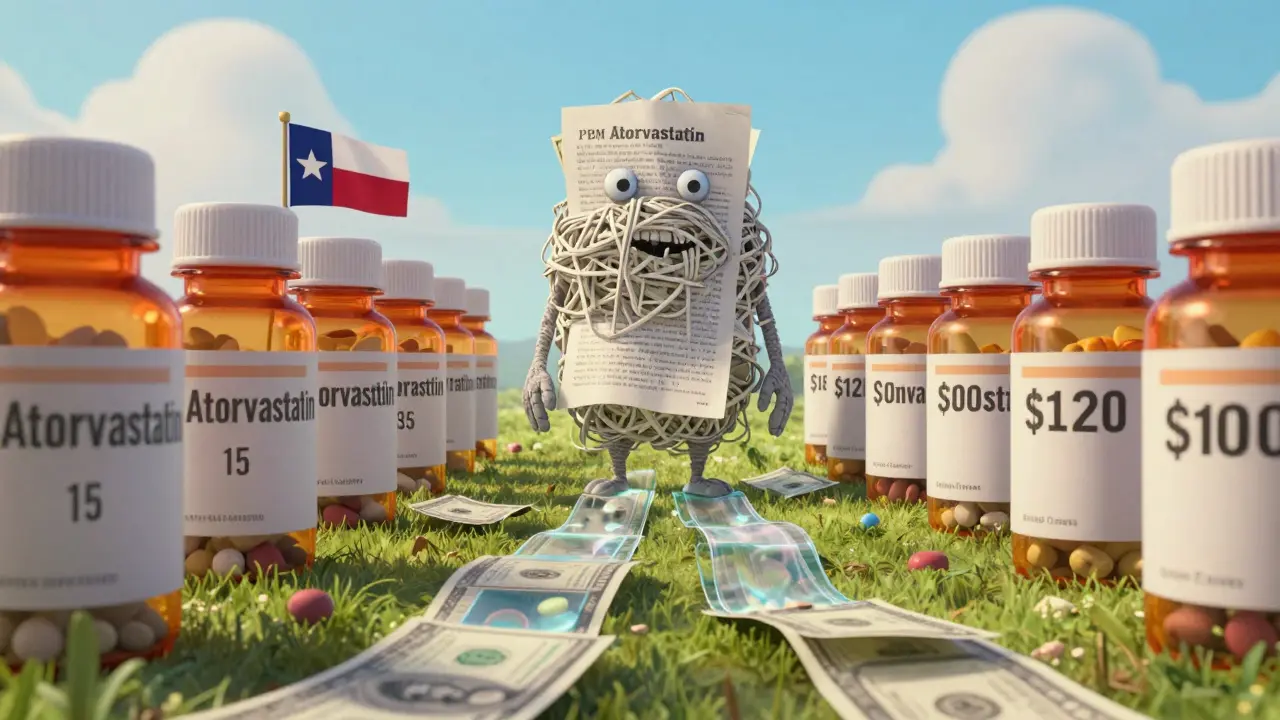

The core reason? Pharmacy Benefit Managers, or PBMs. These are the hidden middlemen between drug manufacturers, insurers, and pharmacies. They negotiate prices, set reimbursement rates, and decide which drugs get covered. But they don’t have to reveal how they calculate those prices. And because each state has different rules about what PBMs can do, the same generic drug can be priced wildly differently across state lines. For example, in states like California and Vermont, laws require PBMs to disclose their pricing formulas and rebate structures. That transparency pushes prices down. In contrast, states with no such laws let PBMs operate in the dark. That’s when you see the same 30-day supply of generic atorvastatin-used to lower cholesterol-cost $15 at a cash pharmacy in Texas but $120 when billed through insurance in New York.How Medicaid and Insurance Reimbursement Create Price Gaps

Medicaid, which covers low-income patients in every state, pays for generics using different benchmarks. Some states use the National Average Drug Acquisition Cost (NADAC), which updates monthly based on actual wholesale prices. Others use outdated formulas or arbitrary caps. That means a drug that costs $0.50 per pill to buy might be reimbursed at $1.20 in one state and $0.75 in another. Private insurers follow similar patterns. If your plan uses a PBM that doesn’t pass savings along to you, your copay stays high-even if the drug’s actual cost dropped. A 2022 USC Schaeffer Center study found that insured patients often pay 13% to 20% more than they would if they paid cash. Why? Because PBMs keep the difference between what they pay the pharmacy and what they charge the insurer. That gap is bigger in states with less oversight.The Cash Advantage: Why Paying Out of Pocket Saves You Money

Here’s something most people don’t realize: paying cash for generics is often cheaper than using insurance. In fact, 97% of cash payments for prescriptions are for generic drugs. That’s because insurance systems are built around complex rebates and networks that inflate prices for the consumer. Services like GoodRx, Blink Health, and Mark Cuban’s Cost Plus Drug Company let you pay directly for the drug at wholesale prices. In states with weak transparency laws, these cash options can save you 30% to 70%. In California, where price data is public, you might save 40%. In states like Alabama or Mississippi, where pricing is opaque, you could save 60% or more. One patient in Florida told a reporter she paid $110 for her generic metformin with insurance. She switched to GoodRx and paid $8. That’s not a typo. It’s the system working as designed-just not for you.

State Laws Try to Fix It-But Face Legal Roadblocks

States have tried to step in. Maryland passed a law in 2017 to stop generic drug price gouging. A federal court struck it down, saying states can’t regulate interstate commerce. Nevada tried targeting diabetes drug prices. The lawsuit was dropped, possibly because manufacturers threatened to sue under trade secrets laws. Still, 18 states have created drug affordability boards as of 2023. These boards review drug prices and recommend limits. California’s board has already flagged several generics for review. But without federal backing, these efforts are slow and uneven. The result? A patchwork of rules where your wallet depends on your zip code.Why Rural Areas Pay More

It’s not just state lines-it’s also how many pharmacies are in your town. In rural counties, there might be only one pharmacy. That means no competition. No pressure to lower prices. No incentive to match GoodRx deals. A 2022 GoodRx analysis showed that in some rural areas, the same generic drug cost 300% more than in nearby urban pharmacies. That’s not inflation. That’s monopoly pricing. And in states without laws requiring pharmacies to disclose prices, patients have no way to compare.

What’s Changing in 2025?

The Inflation Reduction Act of 2022 brought some relief-but only for Medicare patients. Starting in 2025, insulin will cost no more than $35 a month, and total out-of-pocket drug spending for Medicare users will be capped at $2,000. That’s huge. But it doesn’t help the 70% of Americans under 65 who get their drugs through private insurance or pay out of pocket. Meanwhile, the FDA approved 843 new generic drugs in 2017-the most ever. More competition should mean lower prices. But in states where PBMs control the flow of information, those savings never reach the patient.What You Can Do Right Now

You don’t have to wait for lawmakers to fix this. Here’s what works:- Always ask: “What’s the cash price?” before letting them bill your insurance.

- Use GoodRx or similar apps to compare prices at nearby pharmacies. Even within the same city, prices can vary by $20.

- If you’re on Medicare, check if your drug is on the $35 insulin list or eligible for the $2,000 cap.

- Consider switching to a cash-based pharmacy like Cost Plus Drug Company if you take multiple generics.

- Call your state’s department of health. Ask if they have a drug price transparency portal. If they don’t, push for one.

The Bigger Picture

Generic drugs are supposed to be the affordable alternative. But in the U.S., they’ve become another battleground for profit. The system isn’t broken-it’s designed this way. PBMs, insurers, and manufacturers all benefit from complexity. Patients pay the price. The good news? You have more power than you think. Knowing that your state’s laws affect your bill means you can shop smarter. And every time you pay cash instead of using insurance for a generic, you’re not just saving money-you’re exposing how the system really works.It’s not about being anti-insurance. It’s about being informed. And in a country where the same pill can cost 10 times more depending on where you live, that’s the only real protection you’ve got.

It’s wild how the same pill can cost less at a gas station than your insurance lets you pay. I used to just let them bill it until I found out I was paying triple. Now I always check GoodRx first. Feels like we’re all just guessing our way through a system that’s not meant to help us.

It’s not even about being rich or poor-it’s about knowing the rules. And most people don’t even know there are rules.

I work at a community clinic and see this every day. Older folks will skip doses because they think $45 is all they can afford. Meanwhile, the pharmacy tech says, ‘Hey, just pay cash-it’s $12.’ They look at me like I’m lying. It breaks my heart that the system makes people doubt their own eyes.

We hand out GoodRx cards like candy. Not because we’re against insurance, but because insurance isn’t working for them. And that’s not their fault.

Yeah sure, blame PBMs. But you know what’s really driving this? China. The whole generic drug supply chain is controlled by a few factories over there. The U.S. let this happen because we got lazy. We stopped making medicine here and now we’re at the mercy of foreign suppliers who jack up prices when they feel like it.

And don’t get me started on how states like California are just playing politics with drug prices. They think they’re helping, but they’re just making it worse with their regulations.

My grandma paid $110 for metformin too. Then she started buying it from Cost Plus Drug Company for $7. She said, ‘I used to think I was being responsible with insurance. Turns out I was just being scammed.’

I showed her how to order it online. Now she’s got a whole system. She even told her friends. No drama. No yelling. Just… smarter shopping.

It’s frustrating, but there’s hope. More people are waking up. More pharmacies are posting cash prices. More states are trying to force transparency. It’s slow, but change is happening. You just have to be the one to start asking questions.

And hey-if you saved $100 a month on your meds, wouldn’t you tell someone? That’s how this spreads.

I’ve been on the same generic for years. Never thought to check the cash price until my friend mentioned it. Turned out I was paying $67 with insurance. Cash? $9. I felt stupid. But also… kind of powerful?

Now I check before every refill. It’s not about being anti-insurance. It’s about not letting someone else decide what your health is worth.

The author exhibits a profound lack of conceptual rigor in attributing price disparities to PBMs alone. One must consider the macroeconomic implications of pharmaceutical manufacturing, supply-chain logistics, and the legal doctrine of interstate commerce preemption under the Commerce Clause. The assertion that ‘the system is designed this way’ is not merely reductive-it is epistemologically unsound.

Furthermore, the recommendation to use GoodRx constitutes a form of consumer anarchism that undermines the very structure of managed care. One does not ‘shop’ for essential medicines like groceries. The moral implications are staggering.

you know what really happened? the feds let the chinese take over drug making. now they control the prices. they’re the ones who decided your pill should cost 10x more if you live in california. it’s not the pbms, it’s not the states-it’s the globalists. they want you confused so you dont realize your medicine is being held hostage.

and goodrx? totally funded by big pharma. they want you to think you’re fighting the system but you’re just doing their dirty work.

why do people even use insurance for generics anyway. it makes zero sense. i pay cash for everything. i dont care if its 100 bucks or 10 bucks. i just dont let them touch my money. the system is rigged but you dont have to play. just say no to insurance for generics. its that simple.

and if you dont know how to use goodrx you deserve to pay 120 bucks for a pill that costs 2 cents to make

India makes 70% of the world’s generics. Why are you blaming PBMs? The real problem is the U.S. government doesn’t control production. We import medicine like we import cheap shoes. No wonder prices are insane. Build factories here. Stop outsourcing healthcare. That’s the solution.

And stop using apps. Just go to a pharmacy and ask for the price. If they don’t tell you, walk out. Simple.